Since the 18th CPC National Congress, under the strong leadership of the Party Central Committee with Comrade Xi Jinping at its core, China has grasped the new development stage and quickly built a new development pattern that features high quality growth. Fixed asset investment has kept a great momentum with an optimized structure, effectively stabilizing China’s economic growth, strengthening its weak links and boosting the development momentum. Fixed asset investment has also played a crucial role in China’s supply side reform.

I. Steady growth of fixed assets investment promoting high-quality development

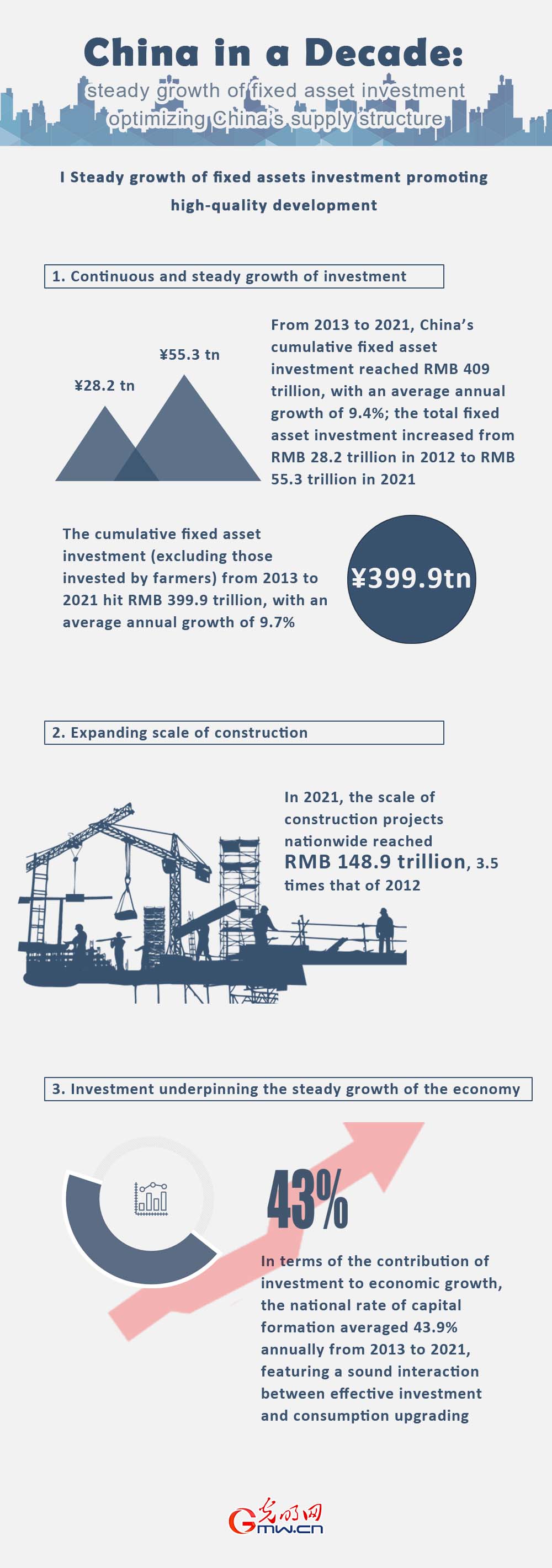

1. Continuous and steady growth of investment From 2013 to 2021, China’s cumulative fixed asset investment reached RMB 409 trillion, with an average annual growth of 9.4%; the total fixed asset investment increased from RMB 28.2 trillion in 2012 to RMB 55.3 trillion in 2021. The cumulative fixed asset investment (excluding those invested by farmers) from 2013 to 2021 hit RMB 399.9 trillion, with an average annual growth of 9.7%.

2. Expanding scale of construction In 2021, the scale of construction projects nationwide reached RMB 148.9 trillion, 3.5 times that of 2012; the scale of new construction projects reached RMB 37.0 trillion, 2.3 times that of 2012.

3. Investment underpinning the steady growth of the economy In terms of the contribution of investment to economic growth, the national rate of capital formation averaged 43.9% annually from 2013 to 2021, featuring a sound interaction between effective investment and consumption upgrading. The Gross Fixed Capital Formation (GFCF) in 2021 contributed 1.1 percentage points to GDP growth, and fixed asset investment played an effective support role to the stable growth of the economy.

II. Optimized industrial investment with a sound structure

1. Solid investment in agriculture From 2013 to 2021, China’s primary industry investment grew at an average annual rate of 13.9%, with a growth rate 4.2 percentage points higher than that of all investment categories. Among which, agricultural investment saw an annual growth of 18.0%, and investment in husbandry increased by 20.7% annually. Since 2012, investment in the primary industry has steadily increased.

2. Accelerated pace of investment in the second industry From 2013 to 2021, China’s investment in the secondary industry grew at an average annual rate of 5.9%. In 2021, technological investment accounted for 36.2% of the total investment in the second industry, 3.8 percentage points higher than in 2012, making technological investment the main driving force of industrial investment.

3. Service industry investment drives rapid development From 2013 to 2021, China’s tertiary industry investment grew at an average annual rate of 8.9%. In 2021, it accounted for 66.6% of all investment categories, 4.9 percentage points higher than in 2012, and 35.9 percentage points higher than investment in the secondary industry.

III. Synergized regional investment empowering coordinated development

1. Investment in four major regions advanced in tandem From 2013 to 2021, investment in the eastern region grew at an average annual rate of 7.9%, with the eastern region accounting for 44.4% of national investment in 2021, down 0.7 percentage points from 2012; investment in the central and western regions grew at an average annual rate of 10.8% and 8.9% respectively, with the central and western regions accounting for 26.2% and 26.3% of national investment in 2021, up 5.4 and 1.8 percentage points respectively from 2012.

2. Coordinated investment in the Beijing-Tianjin-Hebei region, the Yangtze River Delta, as well as the Greater Bay Area From 2013 to 2021, the average annual growth rate of investment in the Beijing-Tianjin-Hebei region reached 5.0%. Hebei’s information transmission, software and IT industry increased by 22.8%. From 2013 to 2021, investment in the Yangtze River Delta (three provinces and one city) grew at an average annual rate of 8.6%, development in the region has become more integrated, its infrastructure has become more interconnected, and a modern, integrated transport system has emerged in the region. The construction of the Guangdong-Hong Kong-Macao Greater Bay Area is booming, with a cumulative investment in fixed assets in the Greater Bay Area exceeding RMB 2 trillion from 2016-2020, growing at an average annual growth of 11.5%, and major infrastructure projects such as the Hong Kong-Zhuhai-Macao Bridge and the Hong Kong section of the Guangzhou-Shenzhen-Hong Kong High-speech Railway have been completed.

3. Investment in the Yangtze River Economic Belt and Yellow River Basin empowering high-quality development Thanks to the development strategy of the Yangtze River Economic Belt, investment in the 11 provinces and cities along the belt grew at a combined average annual rate of 11.4% from 2013 to 2021, 1.7 percentage points higher than the national average; the Yangtze River Economic Belt accounted for 44.3% of China’s total investment in 2021, 8.0 percentage points higher than in 2012. The Yellow River Basin has steadily promoted ecological protection and high-quality development, with a combined average annual growth of 7.8% in investment in the nine provinces of the region from 2013 to 2021. In recent years, the Yellow River Basin has optimally adjusted its economic and productivity layout, its investment growth in 2020 and 2021 was 1.1 and 0.7 percentage points higher than the national average.

IV. Infrastructure investment advances with remarkable result of livelihood-related investment

1.Vigorous investment in construction, transport, and water conservancy projects From 2013 to 2021, national infrastructure investment grew at an average annual rate of 12.0%, 2.3 percentage points higher than that of all investment categories; accounting for 20.5% of China’s total investment, up 5.7 percentage points than that of 2012.

2. Significant leap in investment in information, communications, and public facilities From 2013 to 2021, investment in China’s information transmission industry grew at an average annual rate of 13.7%. At the end of 2021, the number of 5G base stations nationwide reached 1.425 million, 5G networks have covered all prefecture-level cities, and gigabit optical networks covered 300 million households.

3. Investment in real estate and social sectors improves quality of life From 2013 to 2021, China’s real estate investment totaled 103 trillion yuan, with an average annual growth of 9.2%. In 2021, real estate development investment accounted for 27.1% of China’s total investment, 0.7 percentage points higher than in 2012; from 2018 to 2021, investment in the social sector grew at an average annual rate of 11.9%, 7.1 percentage points higher than that of all investment categories. Among them, investment in education grew at an average annual rate of 12.1%, laying a solid foundation for popularization of compulsory education and universal access to higher education.

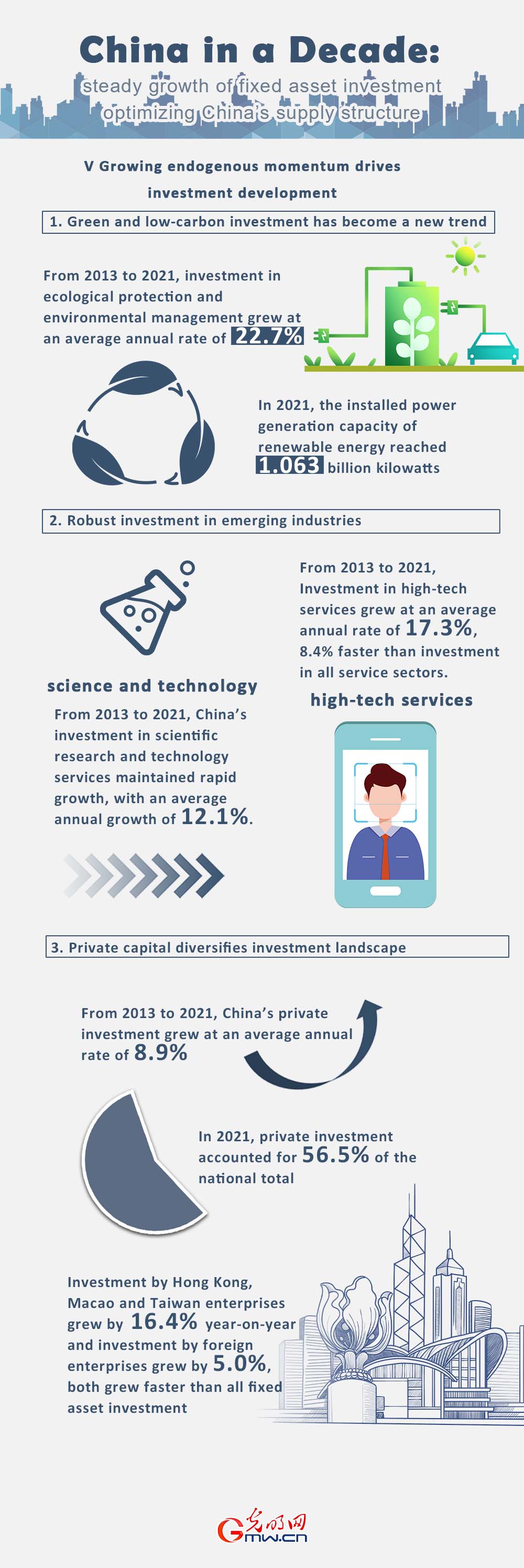

V. Growing endogenous momentum drives investment development

1.Green and low-carbon investment has become a new trend From 2013 to 2021, China’s investment in ecological protection and environmental management grew at an average annual rate of 22.7%, with increasing efforts in ecological protection, continuous investment in environmental infrastructure, and effective treatment of pollution sources. In 2021, the installed power generation capacity of renewable energy reached 1.063 billion kilowatts, accounting for 44.8% of the total installed capacity, with wind and photovoltaic power generation reaching 96.9% and 98% respectively, and new progress was made in the consumption of clean energy.

2.Robust investment in emerging industries From 2013 to 2021, China has placed science and technology innovation at the core of the overall national development, and investment in scientific research and technology services has maintained rapid growth, with an average annual growth of 12.1%. Investment in high-tech industries grew at an average annual rate of 16.3%. Investment in high-tech services grew at an average annual rate of 17.3%, 8.4 percentage points faster than the investment in all service sectors.

3.Private capital diversifies the investment landscape From 2013 to 2021, China’s private investment grew at an average annual rate of 8.9%, accounting for more than half of all investment categories. In 2021, private investment accounted for 56.5% of the national total. Investment by Hong Kong, Macao and Taiwan enterprises grew by 16.4% year-on-year and investment by foreign enterprises grew by 5.0%, both grew faster than all categories of fixed asset investment.

点击右上角![]() 微信好友

微信好友

朋友圈

朋友圈

请使用浏览器分享功能进行分享