Lately, there's been a viral chart circulating on the internet, showcasing substantial increase in U.S. construction spending within the manufacturing sector. This significant economic indicator provides insight into the level of investment and development occurring within manufacturing, and reflects the vitality and direction of a country's economic growth.

Chart showing total construction spending in the manufacturing sector in the United States

Based on data from the U.S. Census Bureau, construction spending by U.S. manufacturers has surged by 71.7% compared to the previous year. In October 2023, the annual rate reached almost $206 billion, up from $121 billion recorded a year earlier.

In the bigger picture, the U.S. economic data for the first three quarters this year appears remarkably strong, with several accomplishments including continuous surge in stock market valuations, sustained decline in unemployment rates, and rapid GDP growth.

Is the U.S. truly embarking on the early stages of a 'manufacturing supercycle' as suggested? Two Chinese economists have pointed out some concerning facts behind the remarkable economic performance shown by the data.

Screenshot showing the article written by Song Xiaojun, deputy director of the Research Institute of China Construction Bank, and Yu Xiang, senior expert at the Research Institute of China Construction Bank

Despite manufacturing growth often driving higher power usage, national electricity consumption has unexpectedly declined compared to 2022, wrote Song and Yu in the article analyzing the U.S. economic data. According to the Short-Term Energy Outlook (STEO) released in this September, U.S. electricity consumption is expected to decrease by 1.26% in 2023, from 4,048 TWh in 2022 to 3,997 TWh in 2023. Breaking it down by sectors, residential electricity usage is forecasted to decline by 2.69%, commercial usage by 1.8%, and industrial usage by 1.39%.

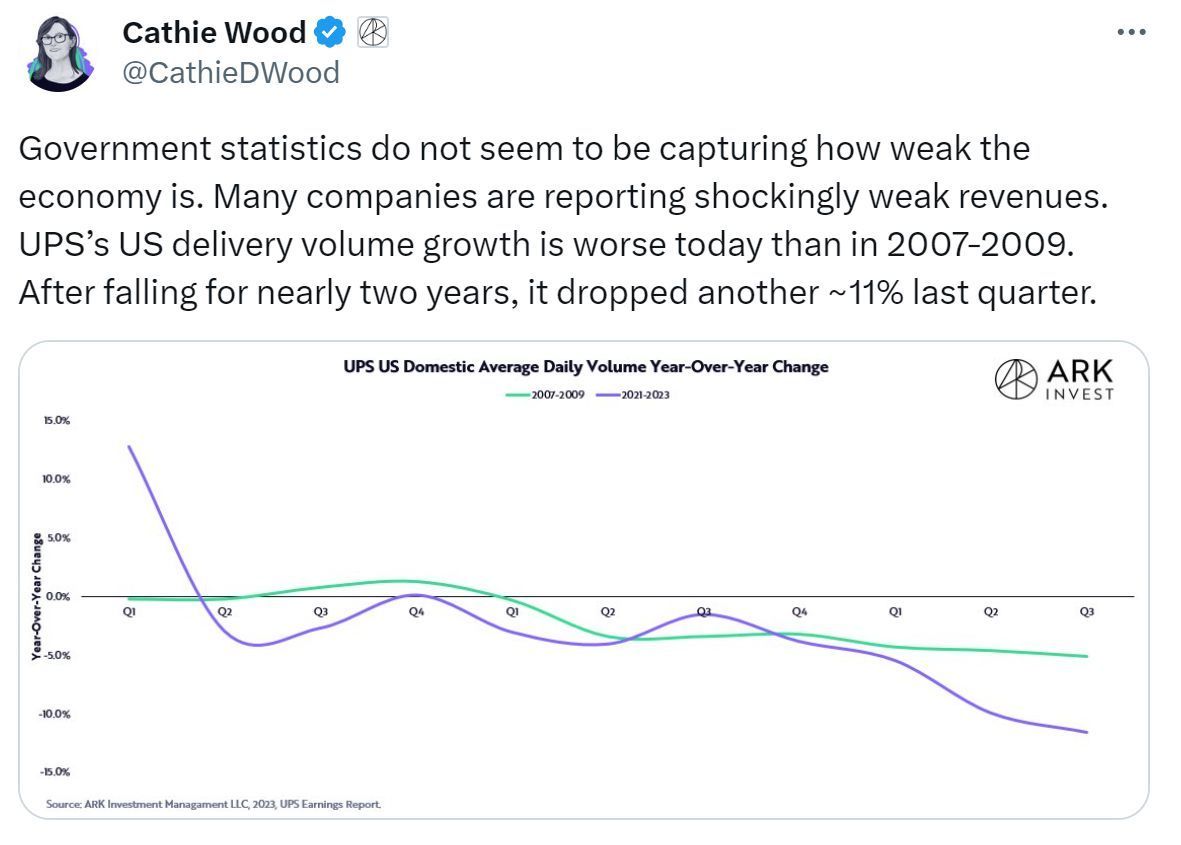

According to the article, the logistics data in the U.S. also contradicts the notion of a swift economic rebound. Cathie Wood, CEO of ARK Invest, has highlighted concerns after analyzing UPS revenue, revealing a decline in daily delivery volumes despite stable market shares among major courier firms. This signals a broader shrinkage in the courier sector. FedEx has also predicted a substantial 25% year-on-year reduction in its national delivery volume for 2023.

Tweet posted by Cathie Wood

Song and Yu also pointed out a stark contrast between two sets of U.S. employment data. The U.S. Bureau of Labor Statistics has reported that September’s nonfarm payrolls rose by 336,000, surpassing the expected 170,000. However, figures from the private firm Automatic Data Processing (ADP) indicated a modest 89,000 increase in nonfarm employment in the same month, well below the anticipated 153,000.

Regarding discrepancies between reported data and the reality, the article further explained that statistical errors could partly account for the aberration. There’s also a possibility that American businesses might manipulate data to secure government subsidies.

A third explanation alludes to “a ‘hidden grand strategy’, aiming to mask deeper economic concerns, attract more capital to the United States, and offset current account deficits with surplus capital,” the article said.

点击右上角![]() 微信好友

微信好友

朋友圈

朋友圈

请使用浏览器分享功能进行分享