BEIJING, Nov. 25 (Xinhua) -- China's central bank on Monday conducted a 900-billion-yuan (about 125.14 billion U.S. dollars) medium-term lending facility (MLF) operation to maintain reasonable and ample liquidity in the country's banking system.

The MLF operation features a one-year maturity period and an interest rate of 2 percent, unchanged from the rate of the previous operation conducted last month, according to a statement on the website of the People's Bank of China.

After the latest operation, the outstanding MLF balance stood at 6.239 trillion yuan.

"The MLF rate follows market trends and fluctuates in sync with market interest rates. Recently, policy interest rates and the loan prime rate, a market-based benchmark lending rate, have remained stable, hence the MLF rate also remains unchanged this month," said Wang Qing, chief macro analyst at Golden Credit Rating.

Some 1.45 trillion yuan of MLF funds will mature this month. The central bank conducted 500 billion yuan of outright reverse repos in October, which was equivalent to releasing a degree of medium-term liquidity in advance.

At present, long-term liquidity in the market remains relatively abundant, analysts stated.

Ancient painting "Lady Guoguo's Spring Outing" to be displayed at Liaoning Provincial Museum

Lianyungang port welcomes largest group of S. Korean travelers under China's visa-free policy

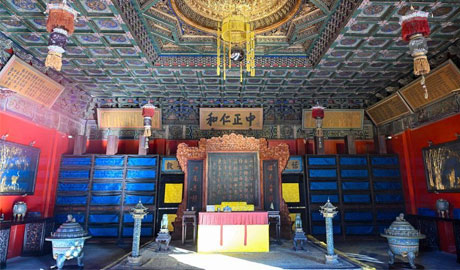

Hall of Mental Cultivation of the Palace Museum reopens to public

Wuyi rock pigment painting in China's Fujian infuses modern artistic elements into tradition

China-Serbia digital art exhibition explores time, space, heritage

点击右上角![]() 微信好友

微信好友

朋友圈

朋友圈

请使用浏览器分享功能进行分享